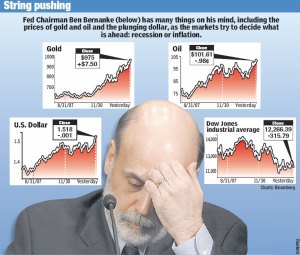

Sorry I haven’t written in a few days…I was in New York, bailing out some banks…just kidding. Although I did consider sending Ben Bernanke a letter asking him to consider picking up my student loan tab. Seriously, there are some serious economic issues in our country, which threaten to send the financial market spiraling out of control. I’m no economist, but I’m trying to figure out how we got here.

The United States and the rest of the world have made some vast improvements in our way of life in the 20th century and this earliest part of the 21st. It was not that a majority of the world was living in squalid conditions—it’s more that countries have made improvements in the depth of experiences we are able to have in our lives. We still live, attempting to make the best out of our own personal situations, but with more options than our ancestors at the close of the 19th century.

The economic policies of Roosevelt, FDR, Nixon, Reagan and the current administration have shaped the markets as we know them, for better and for worse. We have experienced some times of plenty that rival those of other nations. I concede that you have to gamble a little bit for the health of the U.S. economy, but the greed of the top U.S. corporations have put us in the spot we are currently in.

Those of us in the U.S. benefit the most from advancements—from the top levels of our society to the bottom, and every rung in between. But how much have we really benefited from innovation and new “strategies” in business, especially big business? The gluttonous practices that, I’ll admit existed in the Clinton era and prior administrations, have flourished in the last four years, and I’ll venture to say that companies took advantage of our split attentions after the beginning of the war in Iraq.

We live in a scientific age. We benefit from a technological age. We also live in a consumer-based age. Somehow, at the same time, we live in an age where we spend money that we don’t have. Even as Americans exist in these states, they threaten to tear us apart, limb from limb, because they all depend on money. I think the technical folks call that “capital”, and hence we have our Capitalist Society. There has been a lot of talk about the impending doom of investment banking—institutions that, by the way, could only exist in a “capitalist” market—with the bail-out of Fannie May and Freddie Mac, Lehman Bros. recent collapse and yesterday’s $85billion loan to AIG. These companies probably didn’t even know their way out of the mess, that is, until Bear Stearns had to learn for all of them, the hard way. However, all of this goes back even further into the Housing market’s decline, due to unwise lending practices and all the bad debt that came with it. All of which goes back even further, to the happy-go-lucky time when housing prices soared and people could actually afford a tank of gas and their mortgage payment. But…I could go on for days. Hindsight is 20/20 and I hope now that we can see what all the greed that has arisen (well…it was already there) in our economy and the global economy has done for us.

It has been said that the U.S. government’s involvement in saving these gigantic investment firms is bordering on “socialism”. Maybe so, but let’s consider the alternative. In a strictly capitalistic economy, these companies would have been allowed to fail—wreaking unimaginable havoc on markets from here to Japan—through Europe, Africa, the Middle East and the rest of Asia. Imagine a Great Depression, if you will, but one that spans the entire world. The Wall Street banks operated on huge amounts of leverage, which means they borrowed money to “gamble” on bad debts, just to turn a profit. Obviously, they pulled “snake eyes” when they loosened lending practices for home mortgages, and here we are now.

I can’t understand why it is not perfectly visible that the economy’s woes come from things that we want but don’t necessarily need—houses, extended medical care, loans or lines of credit to buy personal technology (TVs, cell phones, etc.)—and while we spend, the prices of things we really do need (food, fuel, water) have skyrocketed due to unprecedented shortages and disruptions in supply.

I wish I had a solution, but the U.S. treasury and the Fed have beaten me to it. The Fed has already committed to a lot of money, guaranteeing money markets. If we are at war, I’m almost certain that we don’t have billions of dollars in reserve to invest in the market as a country. But the government agencies are crafting a plan to create something like the Trust Corporations of the 80’s and the Great Depression, as we speak, in order to keep crisis at bay. The news that our U.S. government is willing to put over 500 billion dollars into bad debt has markets from here to eternity extremely excited–so we haven’t learned a doggone thing about our greed, yet.

Of course, this could be the brilliant move we need to earn our losses in Iraq back—invest in a market that is typically resilient, and make some money for the government so that when they do bounce back, we earn some serious returns.